Lower Your Family’s Tax Burden With A Prescribed Rate Loan

The Canadian Income Tax Act contains attribution rules which prohibit a taxpayer from income splitting with their spouse and certain other family members. Where the attribution rules apply, income earned by the higher income family member is taxed in the hands of that individual, resulting in a higher tax bill for the family unit.

The concept of a prescribed rate loan is to satisfy certain requirements to avoid the application of the attributions rules. If properly implemented and administered, a prescribed rate loan allows a taxpayer to split income with their family members to take advantage of their lower income tax brackets, reducing overall taxes for the family.

This strategy allows a taxpayer to shift dividend income and capital gains realized on public company securities to a spouse, adult children, or even minor children or grandchildren. This strategy can be implemented between two individuals or through an intervivos family trust. Where there are multiple low income family members to which loans can be made, the use of a family trust can be very advantageous.

The strategy is ideal for high- rate taxpayers that have capital available to invest in a passive investment portfolio. In the absence of any further planning, the high-rate taxpayer would invest the cash and earn investment income that would be taxable to that taxpayer.

The prescribed rate loan strategy requires a loan from the higher income taxpayer to the lower income taxpayer or to a trust at an interest rate equal to the Canada Revenue Agency (CRA’s) prescribed interest rate at the time the loan is made.

The CRA’s prescribed interest rate is currently 1% (as of January 1, 2021. Updated quarterly), which makes this strategy particularly attractive right now. If the prescribed rate increases in a future quarter, the effective interest rate on the outstanding prescribed rate loan remains the same as when the loan commenced. The interest on the loan must be paid no later than 30 days after the taxation year (by January 30th) in order maintain the integrity of the planning and avoid the application of the attribution rules.

The timing and payment of this interest is critical. The interest charged on the loan is an income inclusion for the taxpayer making the loan and a deduction for the taxpayer receiving the loan. The proceeds of the loan are invested by the lower income taxpayer or by a trust and allocated to multiple lower income beneficiaries, effectively splitting the income and taking advantage of lower graduated tax rates.

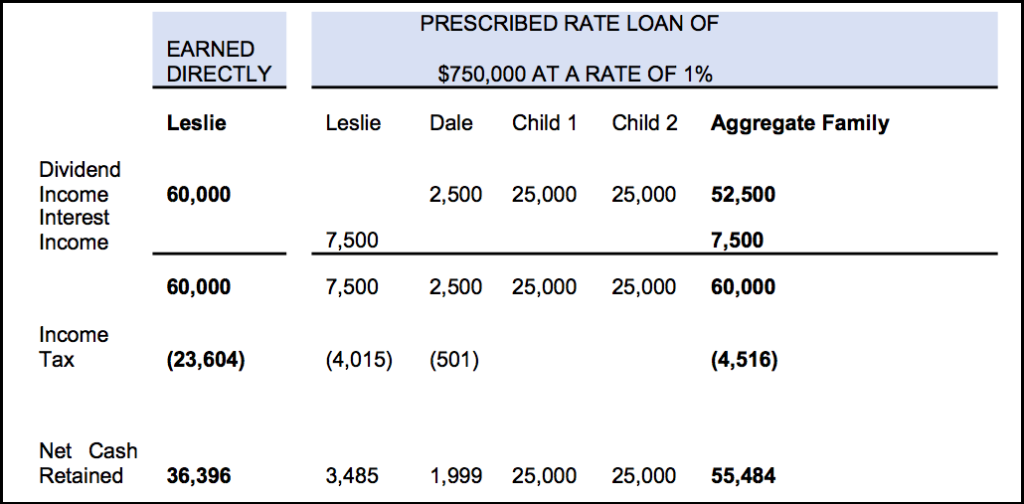

Consider the following scenario for illustrative purposes:

Leslie and Dale are married and have three children. Leslie earns $330,000 of employment income each year. Dale’s income is less consistent, and generally earns $30,000 on average. Leslie and Dale’s two oldest children are enrolled in post secondary education and have no income. Leslie and Dale are assisting the children with their education, cost approximately $25,000, per child, each year.

Leslie has $750,000 of cash available to earn passive investment income. Assume an annual rate of return on investment of 8%, or $60,000 in 2021. For simplicity sake, lets assume the character of the income earned is public company dividends.

In this example, the family save approximately $19,000 per year by holding the investments in a trust and distributing the income among the family members.

In addition to the absolute tax savings associated with using a trust for prescribed rate loan planning, there may be estate planning benefits as well. The growth on the investment accrues within the trust while maintaining control of the assets, allowing for efficient future asset distributions to beneficiaries, where appropriate.

This also allows the application of the deemed disposition rules that could apply to trigger tax on any accrued gains on investments held by the taxpayer in the event of their death to be avoided.

Contact Us

If you are interested in this type of planning, we would be pleased to review your situation to determine its merit in your specific circumstances and to tailor and implement this strategy to benefit you and your family.

Give us a call for more information about this article at (613) 235-2000 or send an email to info@hwllp.ca

Our goal is to provide updates on topical accounting and tax issues. Information contained in this article is not meant to be a comprehensive summary of the issues raised. Rather, we wish to bring what we believe to be important issues to the attention of our valued clients and readers. We would be pleased to discuss any questions that you, the reader, might have in greater detail.